One significant challenge in international consignment is dealing with currency exchange rates. Fluctuations in exchange rates can impact the valuation of consigned goods and the revenue recognized from their sale. Businesses must implement robust currency management strategies to mitigate these risks. Additionally, understanding the tax implications in different countries, including VAT and customs duties, is essential for avoiding legal complications and optimizing tax liabilities. Inventory valuation for tax purposes also presents unique challenges in consignment arrangements.

The 3 Basic Steps of the Consignment Process

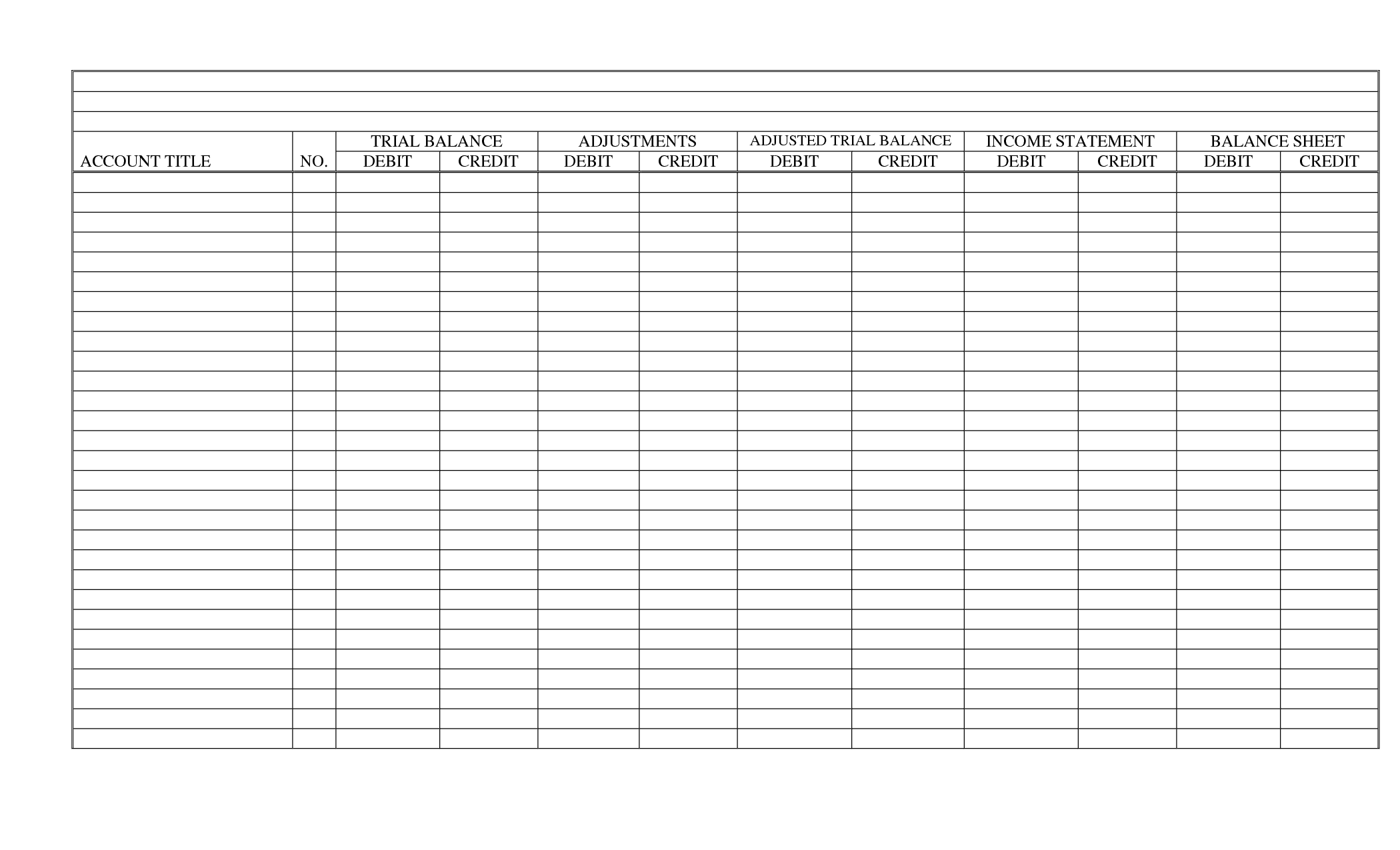

This is because the cost of bringing the inventory to its current location must be considered when calculating the cost of goods sold (COGS). As mentioned, the consignor must use two double entries to record the transaction. The first journal entry used to record the sale proceeds is as follows.

Tax Implications of Consignment Accounting

Once the consignee sells the goods, the risk and rewards related to the inventory get transferred. When it comes to the accounting treatment of consignment inventory, the standards are clear about it. Since the risks and rewards of the goods do not transfer due to the transfer, the consignor cannot record the inventory as sold. One of the major issues that some people have is accounting for consignment inventory. We’re going to cover all of the basics of consignment accounting in this article.

6 Consignment arrangements

Your cash flow can become dependent on the speed at which the retailer can sell the goods. And since you have no control over their day-to-day operations, there are no levers to pull to increase sales when you need to. Consignment inventory refers to goods transferred from a company to another party while still holding its risks and rewards. You may be wondering how consignment accounting differs from traditional accounting.

Accounting for Consignment Inventory (Definition, Treatment, Journal Entry, and Example)

It means the title to the goods that are sent to consignee remains with the consignor even if the goods are present on the shelves of the consignee’s shop. Any loss of goods occurred due to theft, fire or accident etc. will be born by the consignor and not by the consignee. However, if consignee agrees to accounting for consignments bear a certain percentage of loss in the consignment agreement, the loss will be born in accordance with the agreement. He does not make an accounting entry when he receives the goods consigned to him. He may however, keep the record of goods received in a separate book known as consignment inward book.

Inventory management is a critical element of consignment partnerships. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Despite the various advantages mentioned above, there are a few factors from the other end of the spectrum that prove to be a disadvantage.

Supply chain management is integral to running a successful business that sells products. In fact, it’s virtually impossible to succeed in the long run without appropriately managing inventory. One such inventory management strategy to consider is consigned inventory, which we’ll discuss in detail today. Unleashed inventory management software gives retailers, wholesalers, and their suppliers the ability to track stock across multiple warehouses and geographical locations. Plus, you can easily integrate it with all your existing business software for a fully connected system that updates itself in real-time. It’s important to note that the import duty of 200 is debited to the consignment inventory account.

- Consignment allows businesses to sell goods via third-party sellers without requiring the sellers to pay for the goods upfront.

- They need to monitor the inventory received, sold, and remaining on hand.

- The consignee will take a fee for this, while the consignor will retain ownership of the goods while they are unsold.

- Suppliers are often more willing to work closely with consignees to optimize inventory levels, address supply chain issues, and accommodate fluctuations in demand.

In this arrangement, the consignor retains ownership of the goods until they are sold to a third party by the consignee, who is the selling entity. The consignee essentially acts as an intermediary, promoting and selling the consignor’s products without taking ownership of the inventory. The cost of goods sold for consigned inventory is recorded as the consignee’s purchase price plus any added costs, such as transportation or storage fees. This amount is deducted from the sales revenue to determine the gross profit earned on the sale. Any unsold inventory at the end of an accounting period is still recorded on the consignee’s balance sheet as a liability to the consignor.

Consigned inventory is not typically considered a current asset on the consignee’s balance sheet because legal ownership of the inventory remains with the consignor until it is sold. Therefore, it is not included in the consignee’s inventory balance until a sale occurs. Consigned inventory can lead to significant cost savings for businesses. By adopting consignment arrangements, companies can minimize their overhead costs by reducing the stock they must keep on hand.

Navigating the tax implications of consignment accounting requires a nuanced understanding of both tax laws and the unique nature of consignment transactions. One of the primary considerations is the timing of revenue recognition, which directly impacts taxable income. Since the consignor does not recognize revenue until the consignee sells the goods, the consignor’s taxable income is deferred until that point. This can provide a strategic advantage in managing cash flow and tax liabilities, especially for businesses with long sales cycles.